Insolvency is where either a company is unable to pay its debts as they fall due, or when its liabilities exceed its assets. Typically, the company will enter into an insolvency process with an insolvency practitioner. There are various insolvency procedures and the standing of debts owed to employees depends on which procedure is followed and the type of debt owed.

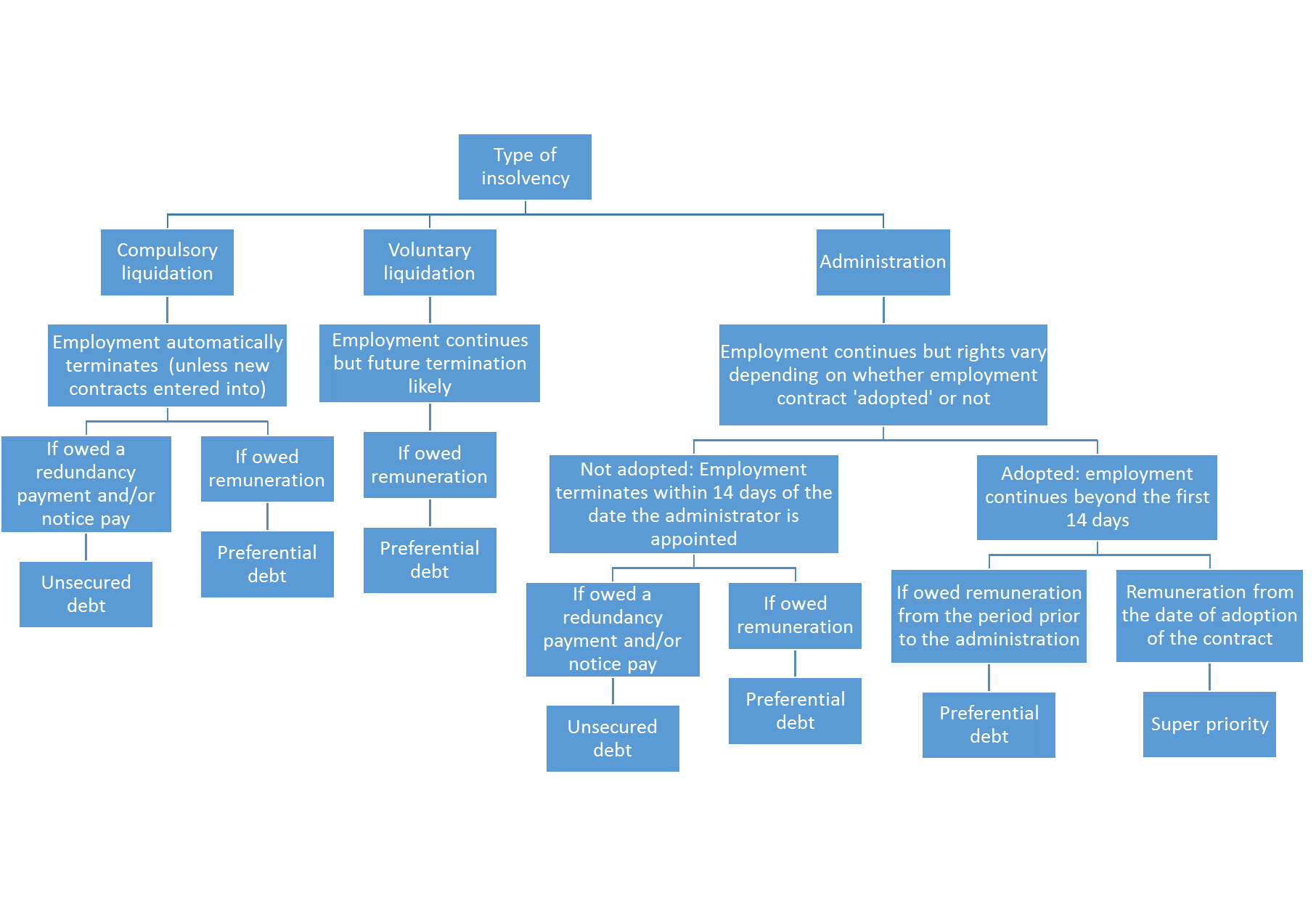

The following flowchart gives an overview of what normally happens to the contracts of employment in each of the most common types of insolvency, and what this means for the debt-ranking of the usual employment-related monies owed.

Ranking of debts

In an insolvency, debts are ranked in order of priority, with the higher ranking payments more likely to be paid out and the lower ranking payments less likely to be paid out. The flowchart shows that the usual employment debts are either ranked as super priority, preferential or unsecured.

Super priority: wages and salary, including holiday pay, sick pay, payments in lieu of holiday and contributions to occupational pension scheme become super priority debts in the event that the employment contract is adopted in an administration. The super priority status commences from the date of adoption. These debts are normally paid in full and rank alongside the administrator's own fees.

Preferential: remuneration is a preferential debt which ranks third in priority in an insolvency process and therefore is usually paid. "Remuneration" includes wages, sick pay, maternity pay, commission / bonus and overtime looking back four months before the insolvency. While this is not subject to the usual statutory cap on a week's pay, the total amount payable under this category is capped at £800, which often means that employees are still left out of pocket even when the debt is paid.

Unsecured: these debts (most commonly redundancy pay and notice pay) rank second to last in an insolvency and so the employee is unlikely to be paid.

How can an employee recover sums owed where they are unlikely to be paid out under insolvency?

Employees can apply to the National Insurance Fund for payment of certain outstanding sums, including outstanding wages, redundancy pay and notice pay. This is a state-guaranteed fund in place to protect employees when their employers become insolvent. However, there are limited categories of debt which can be claimed and, in each case, certain conditions must be met and caps apply.

Application is made via a Form PR1, found on the Insolvency Service's website. It is normally advisable to make this application as soon as possible once you are aware of the insolvency. Recovery from the NIF can take some time but is significantly faster than waiting for debts to be paid out of the insolvent company. Often the insolvency practitioner will assist employees to complete the necessary details on the form. If the application is rejected, then employees have three months to apply to the Employment Tribunal to appeal the decision.

Unpaid statutory payments, such as maternity pay, can be claimed from HMRC. The Pension Protection Fund (PPF) can pay compensation to members of a Defined Benefit scheme if affected by employer’s insolvency. There are also ways in which protective awards can be recovered by employees.

With insolvencies sadly becoming commonplace in recent times, the protections in place for employees have never been more important. However, insolvency is legally complex and employees would be wise to seek legal advice as early as possible in order to maximise the chances of recovering what they are owed.